As the term suggests, the concept of Intelligent Spending is about how well you manage your expenses in a wise and intelligent manner. Expenses happen in personal and professional lives. Expenses are there for each and everything in today’s world. Even a basic necessity like drinking water comes at a cost. Such is the rising inflation and economic conditions in the country. So, how are you going to survive when your expenses are going to be there now, always, and forever?

Two-thirds say current expenses have become difficult to manage

How is the “savings” going to come in your life when all that you earn is all being spent on expenses? Well, that comes with practice, experience, intelligence, and of course willingness. For example, just yesterday I brought a spiritual book on Amazon for Rs. 250. When the parcel got delivered today, my aunt shared that I should have waited for the Amazon sale that will arrive soon on the occasion of Navratri and Diwali instead of spending bucks just like that.

Inflation in S.Korea rises to 24-yr high

I realized that she is right! Had I waited for the sale, I would have got a better discount on my book and even utilized the remaining amount to probably buy another book. I remember then how people who were born in the 1950s rose from poverty level to middle-class levels by just counting each and every penny they earned and even counting each and every money they spent on their living expenses.

For example, I know an aged woman who would be quite calculative of even her food intake, electricity consumption, and how much she would want to spend on a weekend while she goes shopping for vegetables and fruits. That calculative mindset is what made her make some savings out of a low income that her husband earned slogging for 50 long years by working odd jobs.

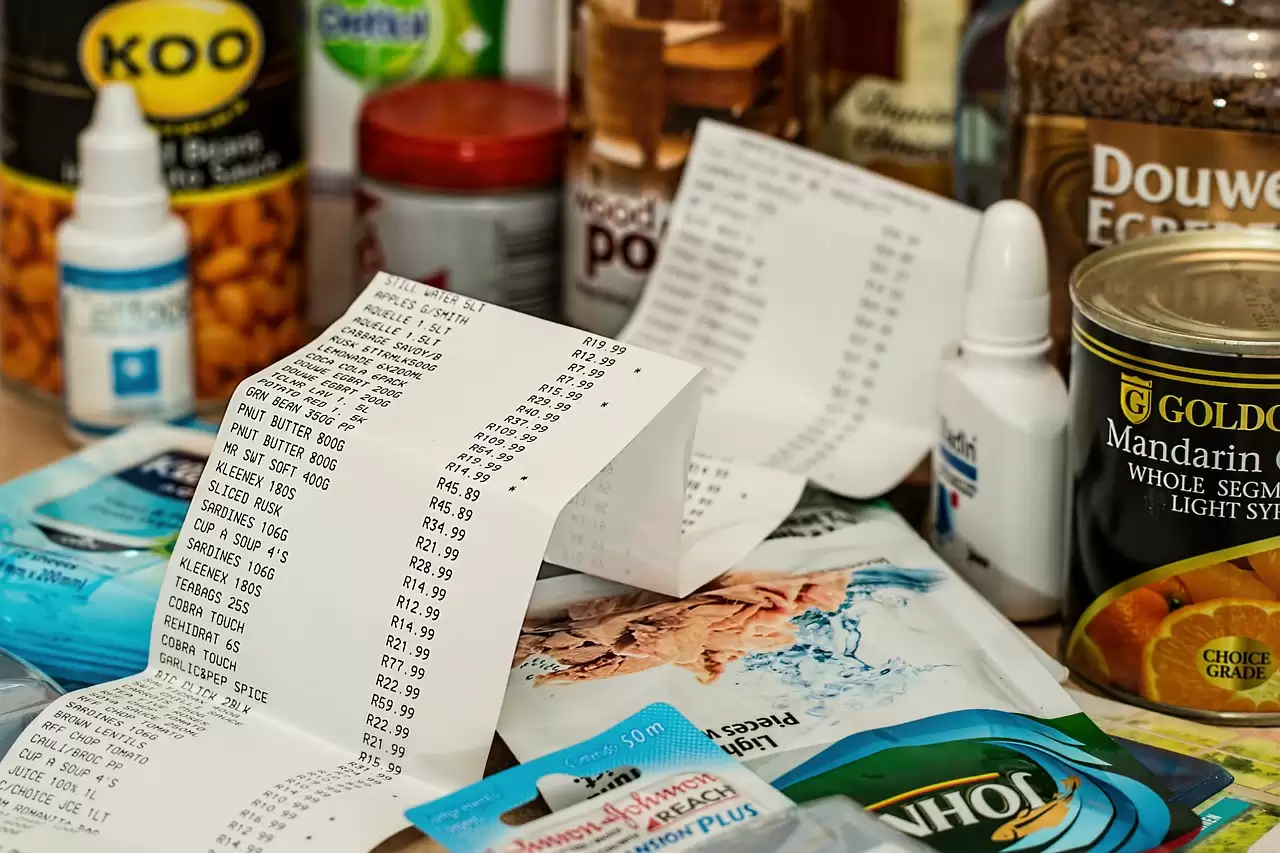

I would find her spending to be quite an intelligent one. It is because she would know her requirements quite in advance and would make a purchase decision on products and services only after enough calculations of the benefits and pros. She would not even make a mistake in terms of her living expenses because she would have planned how much cooking consumption is required for cooking what kind of dish and how well she should put up a list for the requirements of soaps, groceries, etc. for the month so that that much amount lies within the bracket.

Learning wisdom from such experienced people at each and every of our expense is too much for a common person and that too of this generation. But at least managing your credit card bills, debit card payments, and savings for your future like retirement, savings in PPF, LIC policies, insurance, etc. should be made accountable so that you can spend the remaining on your everyday and future requirements.

Intelligent spending doesn’t mean you are too miser and live life without fulfilling your expectations and dreams. But it is about knowing when to spend what and how much benefit you are getting when you are spending each penny on an item or product or service that helps you sustain well.